Market Data Bank

A NEW BULL MARKET JUST BEGAN

From its 1/3/22 record high, the S&P 500 plunged 10½-months, dipping into a bear market in June 2022. On 6/10/2023, stocks closed more than 20% higher than the bear market low of October 2022, beginning a new bull market cycle. At the end of 2Q 2023, stocks were only about 7% lower than its all-time 1/3/2022

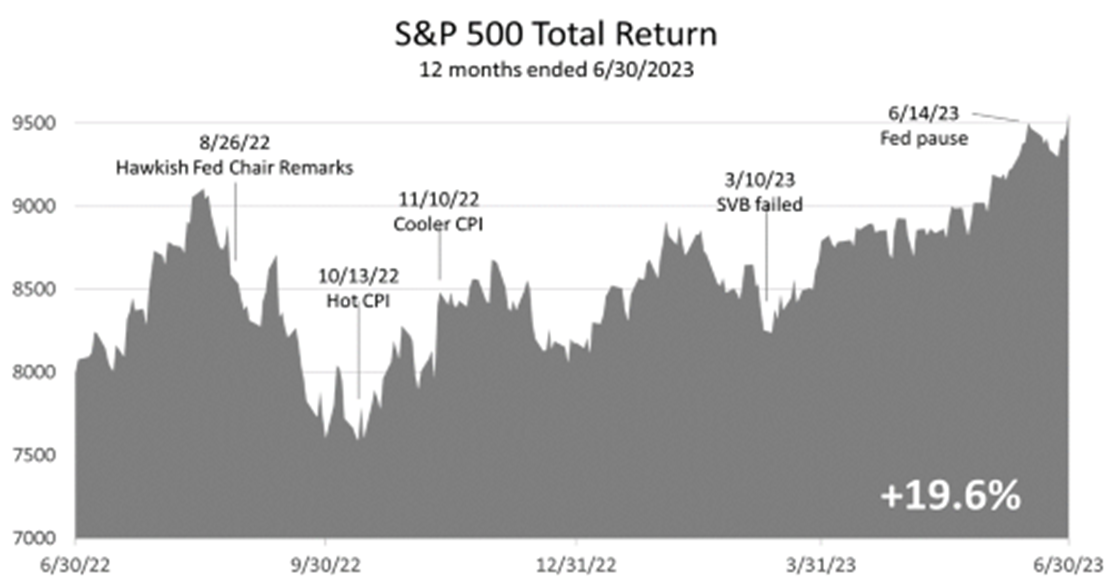

THE BEAR MARKET OF 2022

The economy and stock market were stronger than expected in the 12 months ended June 2023. In March 2022, the Federal Reserve began its most aggressive tightening campaign in modern history, raising rates 10 times 15 months. Stocks boomed anyway! The S&P 500 returned 19.6% in the 12 months ended June 30, 2023.

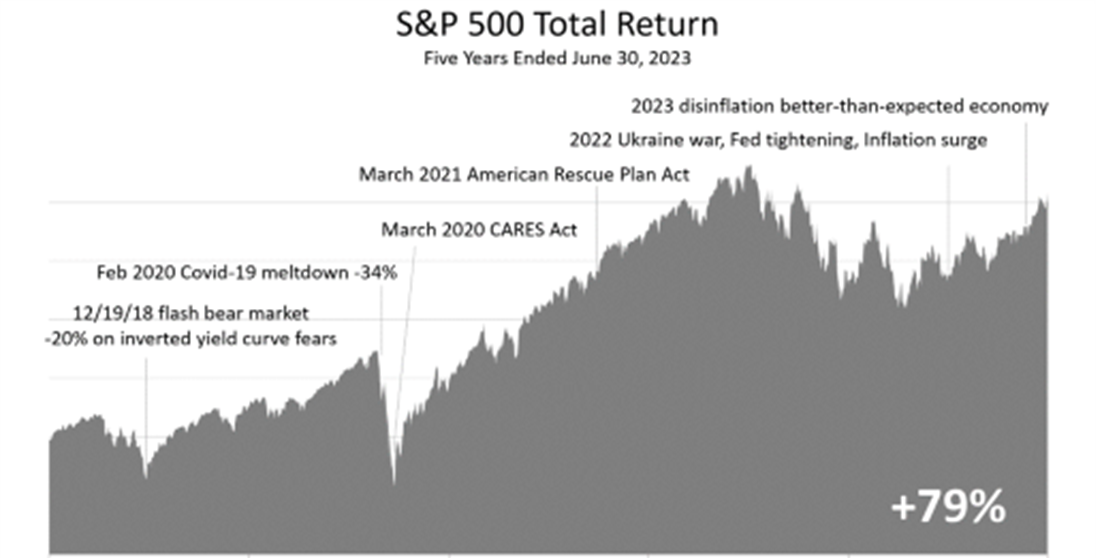

FOUR BEAR MARKETS IN FIVE YEARS

In the five years ended June 30, 2023, the S&P 500 stock index total return, including dividends, was +79%. A $1 investment grew to $1.79. However, it required staying invested in stocks through four bear markets. It’s easy to see why sticking to a strategic plan was the best way to manage portfolio risk.

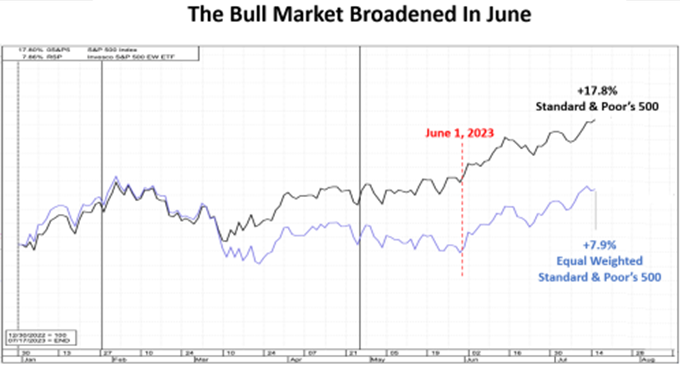

THE NEW BULL MARKET BROADENED

Tech giants Apple, Microsoft, Amazon, NVIDIA, Tesla, Alphabet (Google), and Meta (Facebook) outperformed the other 492 companies in the S&P 500 index from mid-March through the end of May. However, since June 1, the other companies in the S&P 500 index have begun to close the performance gap, as shown in the chart.

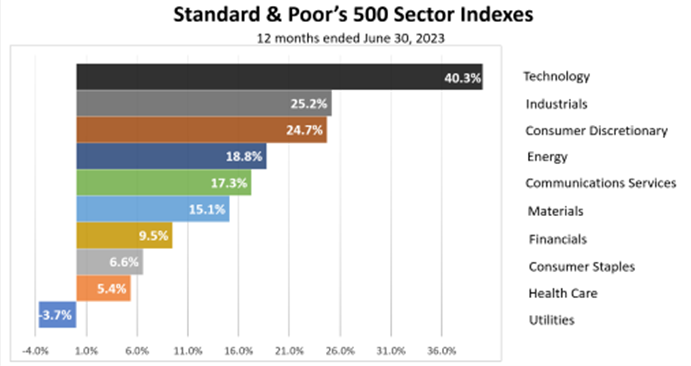

ARTIFICIAL INTELLIGENCE ADVANCES

On 3/26/2023, an advancement in artificial intelligence was released that promised increased U.S. productivity and benefit American tech giants. The 19.6% surge in stock prices in the 12 months ended June 30, 2023, was propelled largely on the 40.3% gain on technology stocks.

THE BIG FAKE OUT OF 2023

Throughout 2Q 2023 economists surveyed by Blue Chip Economics hiked their forecasts. On April 6, the consensus forecast was for the economy to shrink slightly. By July 5, the consensus forecast was for gross domestic product to grow by 1.3%. The preliminary estimate: GDP grew by 2.4%, in a big surprise.

Past performance is never a guarantee of your future results. Indices and ETFs representing asset classes are unmanaged and not recommendations. Foreign investing involves currency and political risk and political instability. Bonds offer a fixed rate of return while stocks fluctuate. Investing in emerging markets involves greater risk than investing in more liquid markets with a longer history. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk of loss. Sources: Sector performance data from Standard and Poor’s. Household net worth data through March 2022 from Federal Reserve Bank of St. Louis, released June 9, 2022; Equity risk premium data from Craig Israelsen, Ph.D, Advisors4Advisors.

.png)