Market Data Bank

THE BEAR MARKET OF 2022

The pandemic, Russian war on Ukraine, soaring inflation, rising interest rates, and growing fears of recession triggered a –4.9% loss in the third quarter, a -16.1% loss in 2Q 2022, and a -4.6% loss in 1Q 2022. On June 13, 2022, the S&P 500 dropped more than -20% from its Jan. 3, 2022, all-time high and a bear market started.

FOUR BEAR MARKETS IN FIVE YEARS

Despite three, consecutive quarterly losses, the S&P 500 stock index over the five years ended September 30, 2022, showed a total return, including dividends, of +55.5%. The period included four bear markets, inlcuding the pandemic meltdown of February and March 2020, when the S&P 500 lost -34% of its value.

INDUSTRY SECTORS

Higher energy prices propelled energy companies to the top of the 10 industry sectors in the S&P 500 stock index, with a +34.9% return in the 12 months ended September 30. Energy was No. 1 for the past four quarters but it was the worst performer for the five previous quarters starting in 4Q 2019.

INDEXES TRACKING 13 ASSET CLASSES

Despite the bear market, No. 1 of the broad array of 13 indexes representing investments for the five years ended September 30, 2022, was U.S. stocks. Bonds and foreign equities were laggards. While energy was a leader in the last year, the index of crude oil investments lost -2.7% versus the +55.5% on the S&P 500 index.

VOLATILITY SPIKES

This chart shows all the one-day drops of 3% or more since 2014 in the S&P 500. Since the beginning of 2022, volatility has increased. Without bear markets and spikes in downward volatility, however, investors would not have an opportunity to earn a return in excess of fixed income investments.

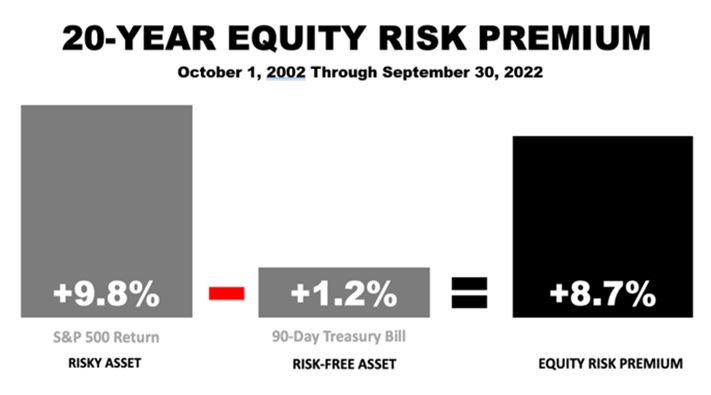

NO SUCH THING AS A FREE LUNCH

Although stocks are a risky asset, subject to periodic bear market drops of 40% or even 50%, they paid a +8.7% premium annually over risk-free 90-day U.S. Treasury Bills for the past 20 years, which included bear markets in 2002, 2008, and early 2020 as well as the 2022 stock market downturn.

Past performance is never a guarantee of your future results. Indices and ETFs representing asset classes are unmanaged and not recommendations. Foreign investing involves currency and political risk and political instability. Bonds offer a fixed rate of return while stocks fluctuate. Investing in emerging markets involves greater risk than investing in more liquid markets with a longer history. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk of loss. Sources: Sector performance data from Standard and Poor’s. Household net worth data through March 2022 from Federal Reserve Bank of St. Louis, released June 9, 2022; Equity risk premium data from Craig Israelsen, Ph.D, Advisors4Advisors.

.png)